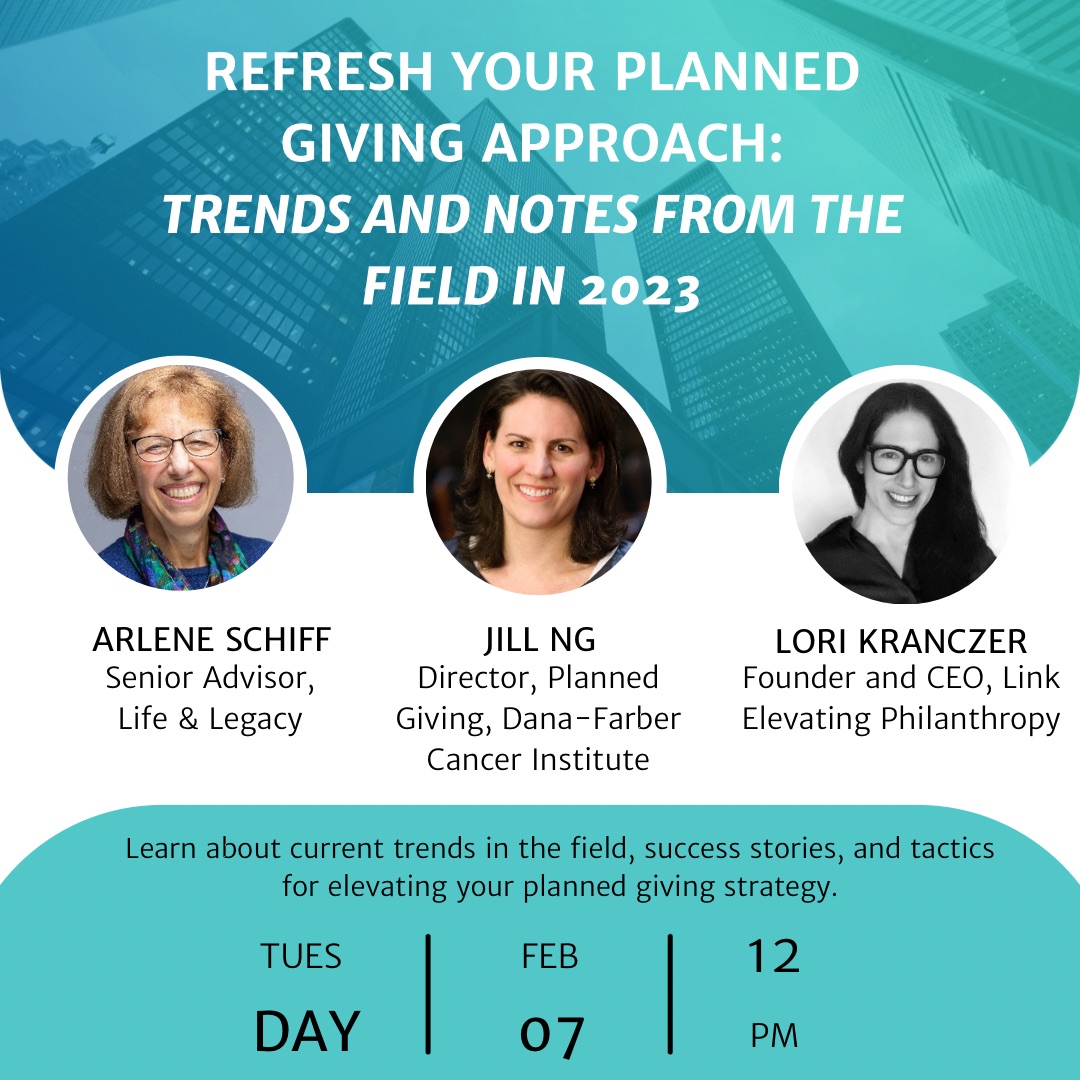

Program Recap - Refresh Your Planned Giving Approach: Trends and Notes from the Field in 2023

“In order for a planned giving initiative to be sustainable, it has to be integrated into an organization's culture." - Arlene Schiff, Senior Advisor, Life & Legacy On February 7th at 12 noon, Women In Development of Greater Boston hosted Lori Kranczer; Founder and CEO, Link Elevating Philanthropy; Jill Ng; Director, Planned Giving, Dana-Farber Cancer Institute; and Arlene Schiff; Senior Advisor, Life & Legacy for an informative discussion about planned giving trends this year, how to steward your planned giving donors and ways to approach the conversation with donors of all ages.

“In order for a planned giving initiative to be sustainable, it has to be integrated into an organization's culture." - Arlene Schiff, Senior Advisor, Life & Legacy On February 7th at 12 noon, Women In Development of Greater Boston hosted Lori Kranczer; Founder and CEO, Link Elevating Philanthropy; Jill Ng; Director, Planned Giving, Dana-Farber Cancer Institute; and Arlene Schiff; Senior Advisor, Life & Legacy for an informative discussion about planned giving trends this year, how to steward your planned giving donors and ways to approach the conversation with donors of all ages.

Key takeaways from the event:

#1: Most legacy commitments come from donors aged 50-75. The average realized gift is about $50,000. Of donors who leave legacy gifts - 50% of donors make their gift through a will and then the other 50% are leaving gifts through an IRA beneficiary designation or life insurance designation.

#2: Recently, there has been an increasing number of Donors Advised Funds (DAF) holders listing organizations as a beneficiary of their DAF. We are seeing an uptick in inquiries about the Secure 2.0 Act and lots of QCDs.

#3: Recognition is so important. Stewardship is an extension of your marketing. An individual's first will is made in their forties. Their first planned gift is in their fifties and then they live well into their 80s. That's a long time that you have to steward your donors. The panelists discussed having 10-12 stewardship touchpoints throughout the first year after the donors give an estate gift.

#4: Most donors change their will in the last two to five years of their lives, so the organization needs to stay front of mind.

#5: When you're having the conversation with younger donors [about bequests and legacy], the conversation is not any different than if you were 80 years old. It's what do you think of our organization, what is important to you, and how would you like to make a lasting impact. Estate gifts are easy in that people do not have to give any money now, but naming a charity as a beneficiary in a retirement plan is a significant way to give.